Having started life in the engines world (Rolls Royce being the first ones to introduce a flight hour agreement 60 years ago that they have branded ‘Power-By-Hour’ or simply PBH – an abbreviation still commonly used today), flight hour agreements have been the must-have for the airlines and not just for engine maintenance, but more commonly for the LRU repair management. Some of the reasons it is a good idea for the operator:

- consolidated maintenance in the face of one or a small number of MROs

- less resource required to manage transactions and suppliers

- improved TAT – less steps in the process

- straight-forward financial planning and alleviating the risk for the operator

- no upfront inventory investment and reduced cost of owning, storing and insuring inventory

So how did the ‘perfect model’ for maintenance cope during most recent events of uncertainty in the world and what is the future outlook – in the days automation, integration and, dare we say it, Blockchain and AI?

Chapter 1 – aircraft grounding during the pandemic

Having enjoyed many years of stability in flight operations, we have now been faced with a new reality – most of the fleet grounded and overall flight hours for the aircraft in operation have gone down to 1000-1500 hrs/annum instead of the more usual 3300-3700 hrs/annum (narrow-body aircraft). Whatever flight hour agreements were in place, would now not make any sense and there were two categories – ones that had the minimum flight hours (3000 hrs typically) and the ones without any (assuming aircraft will continue to fly like they used to).

The ones with the minimum flight hours have quickly become a complete nightmare for the airlines as they now had to pay more than double for their maintenance relative to the flights and could typically survive with the inventory they had without needing a pool access. The ones without the minimum flight hours started burning through the pockets of the MRO providers as aircraft in reduced operation tend to see higher amount of components failing/hr. Similar to your car, maintenance costs are never completely correlated with the number of miles you drive. In addition, if it is parked on the driveway in the snow or under the sun you might be getting all kinds of issues with it over time as it is exposed to the elements with the fluids and materials deteriorating, losing its residual value in the meantime due to depreciation and reduction in warranty coverage.

For the first time ever, we have seen how stress-sensitive flight hour agreements are and how they don’t make sense when the level of operation suddenly shrinks or expands. A lot of airlines and MROs, following some heated discussions, decided to terminate their flight hour agreements in favour of more traditional, transaction-based, Time & Material or Fixed Price repair agreements or at least amend the flight hour agreements to match the new reality.

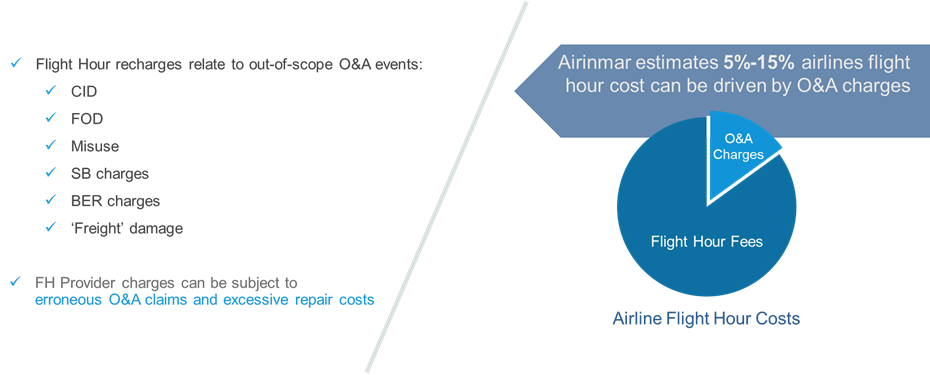

Whatever the outcome was, the flight hour providers were faced with a situation where they needed to actively monitor their costs and push back any 3rd party originated damage (or at least can be described as such) back on to the operators and for the operators to validate such claims and take the time to investigate if the costs are fair and if there is a process that needs to be rectified. It is such a common way of driving overall flight hour contract costs one way or the other – Airinmar has become a specialist in helping Airlines and MROs evaluate the origin of component damage and assisting with recovery of such costs.

Chapter 2 – the new digital era

Before Covid only the most sophisticated MROs and largest airlines could afford to maintain the system, processes and the required headcount to manage a large supplier base. The bigger the airline the more we see them having a number of smaller flight hour of fixed price agreements as opposed to one large flight hour agreement covering the so called ‘nose-to-tail’ spend.

But what if the processes behind managing component repairs were automated, simplified and complete with pre-set rules and prompts to only get involved when required? And what if there was a function to outsource a specific task that can’t yet be automated whenever changes to the supplier base are being made?

There’s definitely tools that can simplify the job of maintaining control over the repair spend and the suppliers performing the work.

There are clear advantages of a flight hour agreement that are beyond the standardisation and simplification:

- Yields a more reliable maintenance program as the suppliers would rather not see repeat events during the term of the agreement

- Pool access – allowing you to share the burden of maintaining parts with a number of other operators. Who wants to have four ADIRUs on the shelf when you can get away with one?

- The larger the purchasing power – the cheaper the costs, whether you are sourcing component repairs or buying spare parts.

Most other benefits are only there to save you admin time and resource, which only needs a system (or a set of) to automate.

So the main question is – does it still make sense to have a flight hour agreement as some benefits will not diminish with higher digitalisation due to the points mentioned above or does it make sense to spend a little bit of time and effort and take back control over your repair spend? And what about 10 years from now – when a smart algorithm can replace entire departments and become the main decision maker?

Flight hour agreements are going to stick around for a while as they, not only provide a simplified management solution, but also additional benefits from a logistics, inventory investment, reliability and overall pricing negotiation standpoint. It is true that larger operators will tend to avoid an all-inclusive nose-to-tail pool access flight hour agreement with an integrator even today, as it is more cost effective to manage repairs directly with the suppliers (even if via smaller flight hour agreements). The ability to consolidate and integrate with the repair supply chain, however definitely puts the small-to-medium sized airlines in the driving seat, but should also give the MROs with a strong focus on digitalisation a competitive edge against the other flight hour agreement providers through lowering own costs and, therefore, offering a better value proposition overall.

Author: Greg Zuikovs, Senior Director Sales & BD